Starting from 1st June , 2025, according to the new government decree, business households and individual business owners in certain cases are required to issue electronic invoices generated from POS systems.

Entities required to apply electronic invoices generated from POS systems include:

(1) Business households and individuals engaging in direct sales and service provision to end-consumers such as food & beverage, restaurants, hotels, etc., who meet one of the following criteria:

(i) Households paying tax under the fixed-rate method with annual revenue exceeding VND 1 billion;

(ii) Households using POS systems;

(iii) Households with small to medium revenue scale operating under the declaration-based accounting and tax method.

![]() The system will automatically send invoices to the tax authorities upon issuance, ensuring transparency and legal compliance.

The system will automatically send invoices to the tax authorities upon issuance, ensuring transparency and legal compliance.

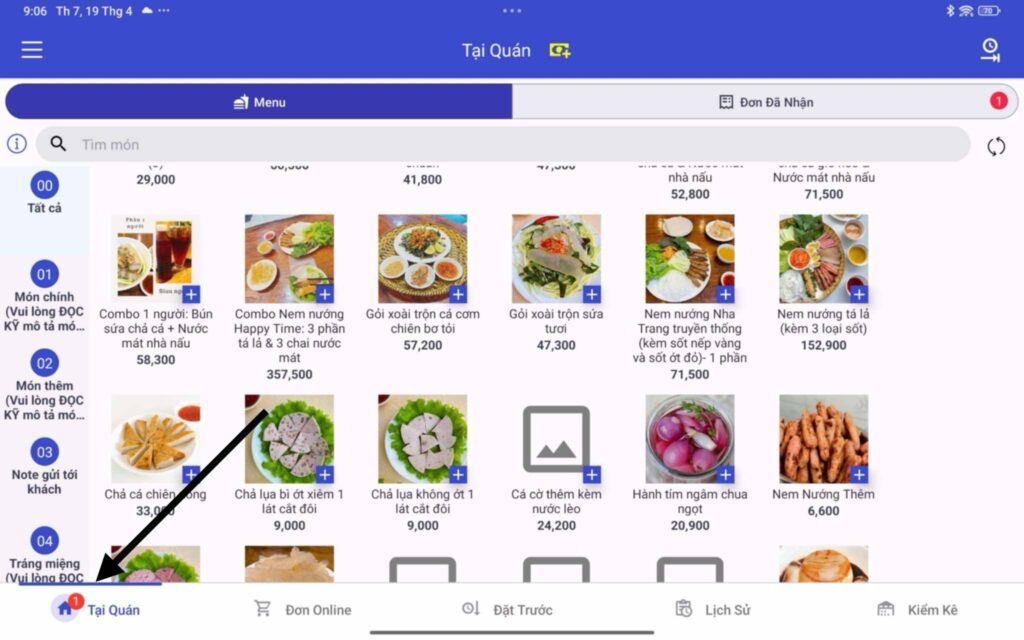

![]() Analy is ready to support you with the electronic invoice integration feature directly on the POS software – enabling quick, convenient, and regulation-compliant transitions for your business.

Analy is ready to support you with the electronic invoice integration feature directly on the POS software – enabling quick, convenient, and regulation-compliant transitions for your business.

![]() What should restaurants prepare?

What should restaurants prepare?

![]() Contact your local tax officer to determine your business model, responsibilities, and the required form of electronic invoicing.

Contact your local tax officer to determine your business model, responsibilities, and the required form of electronic invoicing.

![]() If your business is required to issue electronic invoices via POS, follow these steps:

If your business is required to issue electronic invoices via POS, follow these steps:

Register for e-invoice and digital signature services with a certified provider.

![]() Currently, Analy is integrated with Win Invoice. Please message the Admin for more details!

Currently, Analy is integrated with Win Invoice. Please message the Admin for more details!

Register with Analy to activate the connection gateway between the POS and the e-invoice provider.

![]() Special offer:

Special offer:

![]() Register before 30th June, 2025 – FREE integration of this feature for the full remaining duration of your subscription, applicable to all accounts with At resto In analy app

Register before 30th June, 2025 – FREE integration of this feature for the full remaining duration of your subscription, applicable to all accounts with At resto In analy app

![]() From 1st July, 2025, integration fees will apply as per the policy at: https://account.analy.co/.

From 1st July, 2025, integration fees will apply as per the policy at: https://account.analy.co/.

![]() Don’t wait until it’s too late — take the initiative to register and switch with Analy today!

Don’t wait until it’s too late — take the initiative to register and switch with Analy today!